Budgeting is a way to control your monthly expenses, prepare for life’s unexpected events, and avoid going into debt. Keeping track of your money doesn’t have to be complicated or require a math degree. Although it may seem like it’s a burden to keep track of every single expense, it will help you gain more control over your finances. Keep in mind that you shouldn’t spend more than you make, and you shouldn’t feel guilty about it.

Some apps allow you to create envelopes and allocate monthly spending. You can also create goals and track your spending on each envelope. There are dozens of apps available for creating and maintaining a budget, but the good ones don’t cost a cent. Try Goodbudget to set monthly budgets for each category. GoodBudget Plus gives you unlimited envelopes. You can also use Mvelopes to create a budget. A free version won’t help you make an accurate budget if you don’t know how to use the app.

When choosing a budgeting app, make sure to check the security standards of the company. Most trustworthy budgeting apps have high security standards. To determine whether a budgeting app is secure, visit the security page on its website. Personal Capital and YNAB use encryption that passes U.S. military standards, and they have a security bounty program to ensure their users’ information is secure. You can read more about security on the YNAB website.

Another good app is MoneyPatrol. It connects with multiple external financial accounts, and allows you to set monetary goals for your credit cards. YNAB is convenient because it offers real-time information. MoneyPatrol offers alerts and insights about your budget. It also gives you charts, tables, and panel views for easier reading. You Need a Budget gives you a free trial period of 34 days and a money-back guarantee, so you can see if it’s right for you.

YNAB, otherwise known as You Need a Budget, is another great personal finance app. It breaks down your spending into granular details and helps you allocate every dollar in a way that makes sense. Some of the other apps make budgeting more complex, but YNAB’s user-friendly interface makes it a breeze. You can even sync your account data with YNAB’s platform across multiple devices.

Simplifi, another popular best budgeting app, has been around for a while. Its simple design makes budgeting less daunting, and the tools it provides are incredibly useful. It connects all your financial information, enables you to set financial goals, and tracks your spending. You can even track your expenses based on planned and actual expenses. Using Simplifi will give you a dopamine rush while you’re working towards your goals.

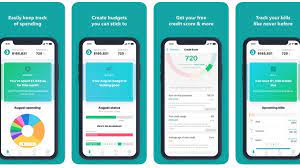

Mint, a popular app for tracking your spending, is a great free budgeting tool. The best budget app allows you to link all your financial accounts, create a budget, and track your transactions from one easy-to-use dashboard. Alternatively, you can download Personal Capital, a free budgeting app from Empower Retirement. This app tracks spending and income and allows you to set weekly spending limits. It also allows you to choose whether to rollover any leftover funds into an account.

A traditional approach to budgeting involves tracking expenses, eliminating debt, and building an emergency fund. However, if you can establish a portion of your emergency fund, budgeting will be easier. An emergency fund acts as a buffer against unexpected costs. It should replace the use of credit cards in an emergency. The key to building a partial emergency fund is to keep contributing to it consistently and think about what you’re spending your money on. You’ll need to be disciplined in this regard.

As a rule, you should begin by estimating your income and expenses each month. Use your pay stubs from last year to get a good idea of how much money you make. You may be surprised to find that your grocery bill was $500 in September, but $700 in November. You can adjust these numbers based on recent events and expenses. Then, use the percentages you determined in step three to make your next month’s budget.

If you have never used a budgeting app before, you should try Mint. It will sync with your accounts and automatically categorize transactions. Mint will also notify you if you are about to go over your spending limit and remind you to cut back on unnecessary purchases. Mint also offers subscription management and investment trackers. If you’re interested in budgeting apps, it’s important to find one that suits your needs. There are a lot of great budgeting apps on the market, so get started today.

If you looking Business Insurance Agency in Rochester NY so you can consult with GGIANY.COM for further information across USA