If you’re like most people, you probably dread making your monthly mortgage payment. It can feel like you’ll never get out from under the debt. But what if I told you that you could be mortgage-free in just five years?

Sounds too good to be true, right? Well, it’s not. By following a few simple steps and making some changes to your budget, you can pay off your mortgage in five years or less. So how do you do it? Keep reading to find out.

Create a budget

Creating a budget may not be the most exciting way to spend an afternoon, but it is an essential first step in taking control of your finances. By carefully tracking your income and expenses, you can get a clear picture of where your money is going and identify areas where you can cut costs.

This may mean making some sacrifices, such as eating out less or giving up your cable TV subscription, but the extra money you save can go towards your mortgage. In the end, creating a budget is a worthwhile exercise that can help you take control of your financial future.

Increase your income

One important factor to consider when thinking about how to pay off your mortgage faster is your income. If you can find ways to increase your income, you’ll be able to put more money towards your mortgage each month, which will help you pay it off faster. There are a few different ways you can go about increasing your income.

You could look into getting a promotion at work or taking on additional side hustles. The more money you can bring in each month, the faster you’ll be able to pay off your mortgage. So if you’re looking for ways to speed up the process of paying off your mortgage, take a close look at your income and see if there are ways you can increase it.

Make extra payments

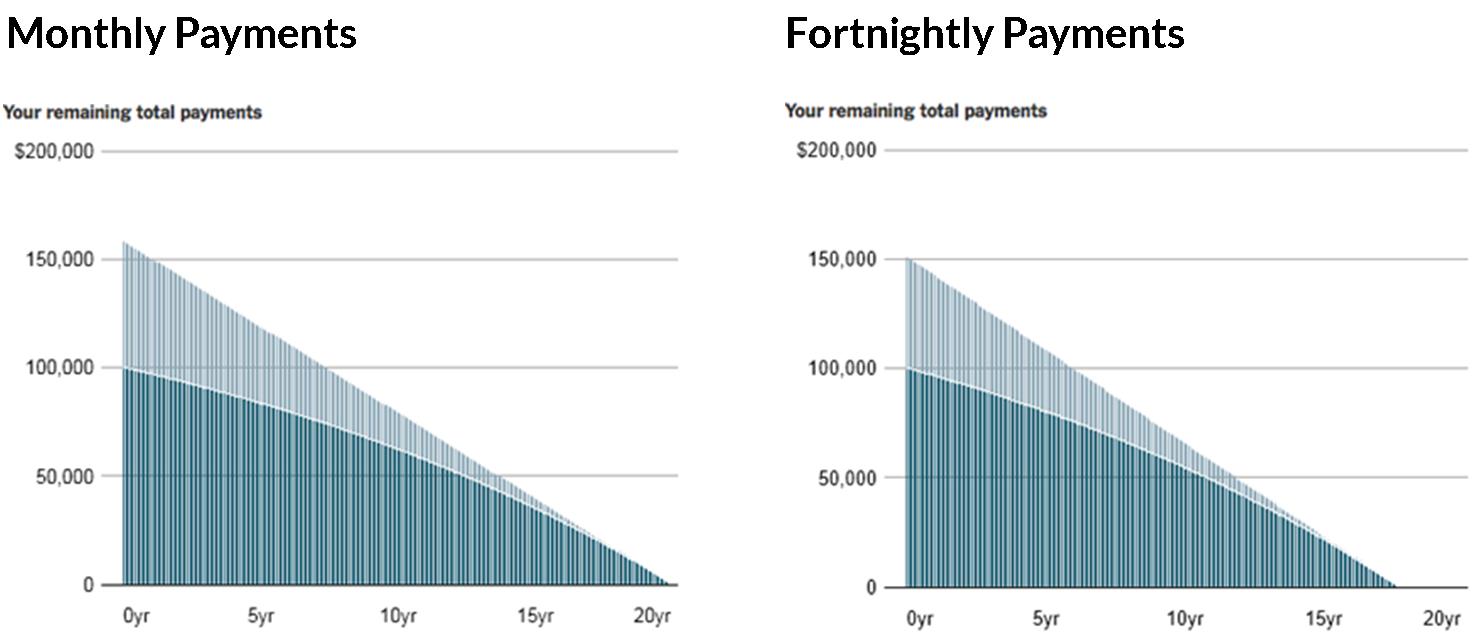

While most people focus on making their regular monthly mortgage payment, there are other ways to reduce the amount of interest you pay over the life of your loan. By making extra payments whenever possible, you can significantly reduce the amount of interest you owe.

Even an extra $50 each month can make a big difference. If you get a tax refund or bonus at work, apply it towards your mortgage balance. In addition, you may want to consider refinancing your mortgage to get a lower interest rate. By taking advantage of these opportunities, you can save yourself thousands of dollars over the life of your loan.

Refinance your mortgage

If you’re struggling to make ends meet, refinancing your mortgage may be a good option. This can help you lower your interest rate and monthly payment, making it easier to pay off your debt. You may also be able to extend the term of your loan, giving you more time to pay it off.

However, you should keep in mind that refinancing comes with some risks. You’ll likely have to pay closing costs, and if you extend the term of your loan, you’ll end up paying more in interest over the long run. Before you decide to refinance, be sure to weigh the pros and cons carefully.

Consider a shorter loan term

When you’re shopping for a mortgage, one of the most important choices you’ll make is the loan term. A longer loan will have lower monthly payments, but you’ll end up paying more in interest over the life of the loan.

A shorter loan will have higher monthly payments, but you’ll save money on interest and pay off your debt much sooner. If you can swing the higher monthly payments, a 15-year mortgage is ideal. You’ll save money on interest and be debt-free much sooner than with a 30-year loan.

The bottom line

If you’re tired of making your monthly mortgage payment, there are steps you can take to pay it off sooner. By creating a budget, increasing your income, and making extra payments, you can be debt-free in five years or less. It may require some sacrifice, but it’ll be worth it in the end. So start taking action today and get on the path to becoming mortgage-free!