Introduction

For the first time in the history of Indian taxation, all indirect taxes have been combined into one single tax levied on the people. The GST certificate is important as it serves as valid tax identity proof of a business registered under Indian GST laws. Business owners can obtain their GST certificate from the official GST portal. The certificate is not issued in physical form and can only be downloaded from the GST official website.

What is a GST certificate (Form GST REG-06)?

The GST certificate is the official/legal proof of a business’s existence, indicating that it is liable to pay and collect goods and services tax (GST). This certificate contains vital information such as the GST-IN, name of the enterprise, date of registration, etc.

According to the norms of the Government of India, it is important for business and shop owners to register under GST, obtain the certificate, and display it in their establishment. Failure to display the certificate can result in a penalty of INR 25,000.

If you are a business or shop owner and are looking to apply for an Udyam Certificate, you can visit this link for a step-by-step guide on how to apply for a Udyam Registration Certificate.

Elements of GST certificate

The GST certificate contains various essential information, such as:

- GST – IN (Goods and services tax identification number)

- Legal name of the entity

- Constitution of business – private/public/LLP/partnership

- Address and place of business

- Approving authority

- Type of registration done

- Date of issue of certificate

- Who must register for the GST certificate?

- Business enterprises providing services with a yearly turnover of INR 20 lakhs must obtain a GST certificate. Entities selling goods with a yearly turnover of INR 40 lakhs must mandatorily register.

Why is it important to have a GST registration certificate?

GST registration comes with various benefits that enhance businesses/entities in various ways, such as:

- Legal recognition

- Claim Input tax credit – reduce the tax burden

- Increases reliability as a business

- Immunity from getting penalized

How to get a GST registration certificate?

To obtain a GST certificate online, follow these simple steps:

- Log on to the gst.gov.in portal and fill in your credentials log In ID/Password.

- If you are a new user, fill out the necessary details and create your account on the portal.

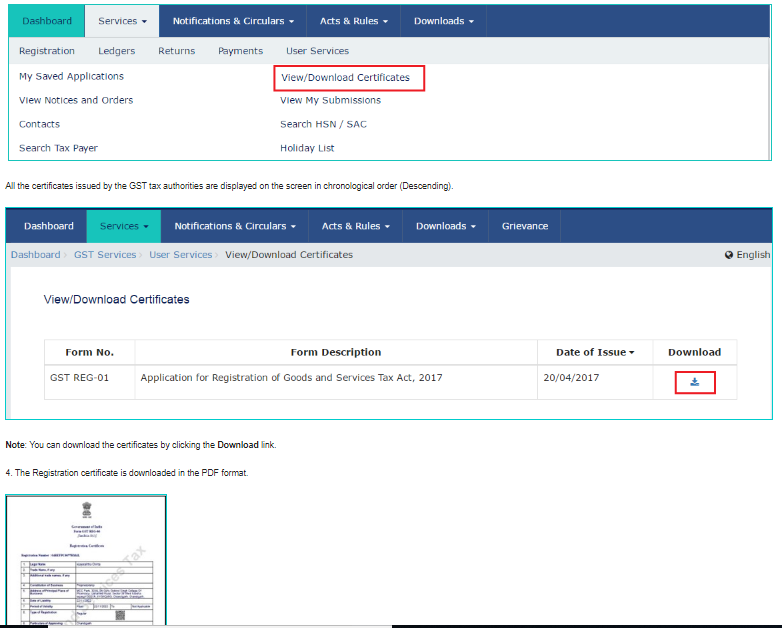

- Go to services, look for user services, and click View/Download Certificate.

- On the new page opened, you will see the option to download a GST certificate having the heading GST REG -01.

Now you have a GST certificate downloaded in PDF.

How to revise the GST registration certificate?

In some exceptional cases, if there are illegible information in the registration at the portal, it can be corrected. Approval from the tax officials/officers is required. After your approval gets acknowledged, a new certificate will be issued. However, the amendment can be done by following these few simple steps:

- Log on to your GST portal using your valid credentials.

- Go to the services section, and search for registration, where you will find the “Amendment to Registration core fields link.”

- Update the information that needs to get changed.

- Click on the verification tab and go through the verification check.

- Select the authorized signatory.

- In the place field, mention the name of the place.

- After filling in details in the “Amendment to Registration” using a Digital signature certificate, sign the application.

Things that you can’t change in GST certificate

In the registration certificate, certain sections cannot be changed/rectified, such as:

- PAN number details

- Adjustment in the constitution of business

- Change in the business place because GST is state-specific

What is the expiry date of the GST certificate?

If you are an ordinary taxpayer, your GST certificate will never expire if issued by the GST department. In the case of a normal person, if the department does not cancel the certificate, it will be valid forever. In the case of a certificate issued to a casual taxable person or a non-resident of India (NRI), it will be valid for 90 days or for the period mentioned in the application while registering, whichever is earlier. It can also be extended under section 27(1).

FAQs

What is the use of a GST certificate?

It is considered valid proof of business registration under Indian GST laws.

Is the GST certificate mandatory?

The government of India issues GST registration certificates, and it is mandatory for every business to have a GST certificate.

What are the different types of GST?

There are four types of GST available in India: IGST (Integrated GST), SGST (State GST), CGST (Central GST), and UTGST (Union Territory GST).

Can I start a business without a GST registration certificate?

Yes, one can start a business without a GST registration if the amount and turnover are below the threshold limit.

What is the bill of entry in GST?

In GST, Bill of Entry encompasses IGST, GST and customs duty paid by the importer as well.