An organisation is known by its people and how well it treats them. This is the prevalent modern-day business philosophy among large corporations and Australian enterprises with overseas operations. The rapid evolution of human resources as a critical component of an organisation’s wellness has necessitated the transformation of HR and payroll functions into a futuristic process. Today, the power of cloud payroll software is helping transform HR functions from inefficient legacy processes to automated and high-impact services.

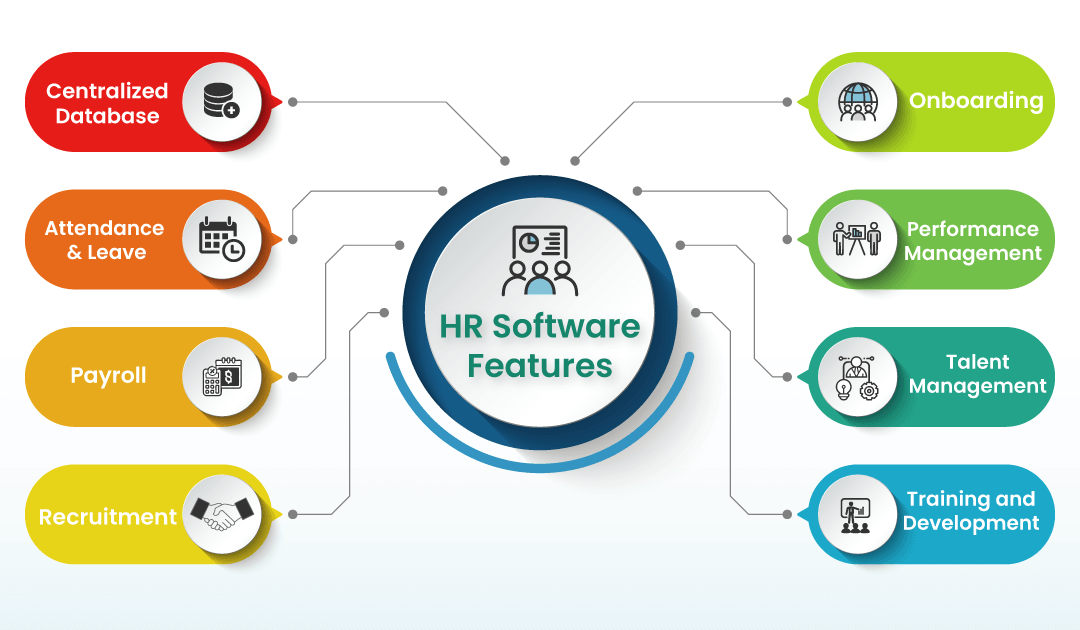

A good HR payroll software can allow you to use your company’s human resources better. It will allow you to focus on their efficiency and well-being instead of making you spend time trying to streamline things and worrying about future changes. As an international brand based in Australia, the time is ideal for you to revamp your payroll software. A leading global payroll software will allow you an integrated management by bringing together employee onboarding, time and attendance and other core HR functions in a single window. Not only that, being cloud-based, a modern HR payroll software will also allow you to manage your global workforce from a single platform.

Advanced HR Payroll Software features for Australian Businesses

- Online generation of payslips

- Automated tax calculations and deductions

- STP compliant (with readiness for STP 2 compliance)

- Option to create rules based on modern awards or Enterprise Bargaining Agreements (EBA)

- Full cloud integration for global operations

- Dynamic scalability

- Local tech support across different territories and countries

- ATO certification

- Superannuation processing

- Parallel testing

- Transfer of current payroll and staff data from existing payroll software

- Regularly updated in line with local regulations

For Australian businesses running international operations, it is important to not only comply with the Australian laws and regulations but also to adhere to the payroll rules and scenarios as applicable across different countries.

The multi-country HR payroll software would allow you to create standardised organisation-specific rules and policies which will be equally applicable across all operational territories. Further, the payroll software will also be automatically aligned to receive updates about changes in regulatory requirements across more than 50 major countries across regions such as:

Asia/Pacific: Singapore, Malaysia, Taiwan, Indonesia, Philippines, Vietnam, Thailand, Hong Kong, India, Bangladesh, Pakistan, Kazakhstan, South Korea, China, Macau, Sri Lanka, Myanmar, Nepal, Japan, Brunei, and Cambodia

Middle East and Africa: Bahrain, Kuwait, Oman, Qatar, Saudi Arabia, United Arab Emirates, Yemen, Iraq, Lebanon, Jordan, Egypt, Morocco, Cyprus, Turkey, Sudan, Republic of S. Africa, Tanzania, Nigeria, Ghana, Kenya,Algeria and Mauritius

Oceania: Australia, New Zealand, Papua New Guinea, and East Timor

Europe: United Kingdom and Ireland

Americas: US

To cater to the diverse global human resources your payroll software should also be capable of defining your business logic for Earnings, Deductions, Bonus, Arrears, Leave and Attendance. It will offer standardisation of processes across all the locations and take into consideration the variations within individual and local geographies and cultures. Not only that, but an advanced payroll software would also seamlessly deal with multi-element, multi-decimal, multilingual and multi-country payroll services.

While choosing a payroll software for your organisation, make sure that your service provider is well-versed with the Australian business environment as well as capable of offering seamless, accurate, on-time and flexible service to your distributed workforce.