Did you know that over 66 million people are covered by Medicaid in the United States? Many times people use the words Medicare and Medicaid interchangeably without realizing that there is a difference. If you are confused with the terms and are trying to decide between one and the other, you are in the right place.

Keep reading to learn all about the differences between Medicare and Medicaid.

Medicare and Medicaid Similarities

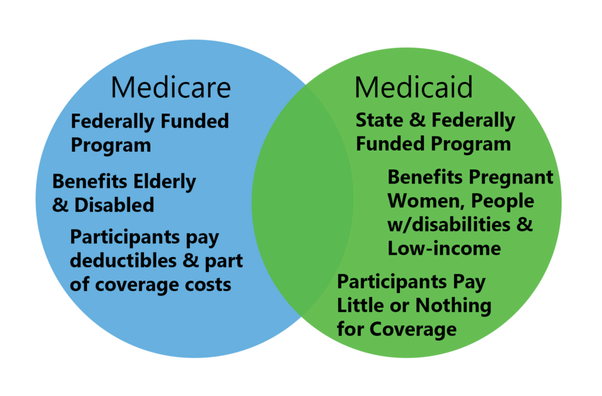

Both of these programs are sponsored by the United States government to help cover healthcare costs for American citizens. They were both established in 1965 and they are both funded by taxpayers.

When you understand your options it makes it easier to make an informed decision.

Medicare

Medicare helps United States citizens that are 65 years of age or older. It provides them with healthcare and it is also available for people with certain disabilities even if they are not 65 years old yet. Medicare consists of four parts:

Part A

This part gives hospitalization coverage to those 65 years of age or older no matter what their income level is. In order to qualify for Part A, you or your spouse have to have worked and paid Medicare taxes for a minimum of 10 years.

Generally, Part A will cover skilled nursing facility care, inpatient care in a hospital, hospice care, and home health care. Usually, there are deductibles and coinsurance that has to be paid when using Part A, but the premium doesn’t cost anything.

Part B

Anyone who is eligible for Medicare Part A can also qualify for Part B. Part B covers services and equipment that are medically necessary for a patient. This includes things such as a doctor’s visit, wheelchairs, lab work, x-rays, walkers, outpatient surgeries, disease screenings, flu shots, and other preventative services.

The standard Part B premium in 2020 is $144.60. This is usually deducted from Social Security or from Railroad Retirement payments automatically. Keep in mind that coinsurance and deductibles do apply to Part B services.

If you earn more than $87,000 per year or $174,000 for couples then you will have to pay more for Part B.

Signing up for Part B is not mandatory if you are still covered by your employer’s insurance. But, if you join later in life you might have to pay more because they charge a late-enrollment penalty for waiting.

Part C

This is supplemental insurance that is available for those that are eligible for Part A and Part B. Part C is also called Medicare Advantage. These plans are offered by private companies that Medicare approves.

Part C offers the same coverage that Part A and Part B offer plus hearing, dental, and vision coverage. Enrolling in this might actually reduce your costs of purchasing your services separately.

When deciding whether or not to enroll in Part C you want to take the time out to carefully evaluate your medical needs because Part C participants pay out of pocket for the associated services, most of the time.

If you need help covering expenses like coinsurance, deductibles, and copayments that Part A and Part B do not cover, you might want to look into purchasing what is known as Medigap. Keep in mind that physicians that do not take Medicare will not accept Medigap either.

Part D

This part covers prescription drug coverage. Those that have Part D pay for it out of pocket and they also have monthly premiums to pay along with a yearly deductible. Certain prescriptions also have an extra copayment that has to be paid by the patient.

If you are enrolled in Part C you are more than likely also eligible for Part D.

100% Coverage

If you do not want to worry about not being covered it is best to also opt for a Medicare Plan F and Plan G option. If you are confused about what to do, you can speak with a qualified insurance agent or a Medicare advisor to find the plan that fits your needs best.

Plan F

This is the most comprehensive plan which is why it has been the most popular choice for many years. The average cost of Plan F was $169 per month as of 2018. However, as of January 1, 2020 Plan F is not available for newly eligible people.

Those that already have Plan F are allowed to keep it.

Plan G

This plan will replace Plan F overtime in popularity. It is virtually the same coverage with the difference that the reimbursement of the Part B deductible that used to be covered is no longer covered. This perk will no longer be available to any new Medicare newbies.

The average Plan G will be around $180 less per year than Plan F.

Medicare Deductible

If you are admitted to a hospital and you have 100% hospitalization coverage after the annual deductible (which is $1,408 under Original Medicare Part A as of 2020). This means that first, you will have to pay the $1,408 deductible, and then basic bed and board will be covered. Keep in mind that you might have to pay other costs such as the anesthesiologist fees or any other extras.

If you are hospitalized for over 60 days then you will have a per-day copayment. With the current fee schedule as of the writing of this post, you will have to pay $352 per day. For long term stay in hospices or nursing homes you can expect to have similar copayment amounts.

A regular doctor visit or an outpatient medical service might cost you money too. Your deductible is $198 but after this, you will pay up to 20% of the Medicare-approved amount for most of the doctor services.

Medicare Eligibility

This is the major difference between Medicare and Medicaid. Medicare is based on disability or age while Medicaid is based on income. If you meet the income and age requirements for each program then you can be eligible for both and this is called “dual eligible.”

If you have both then a system called coordination of benefits (COB) will decide which insurer will pay for your coverage first. This means that you won’t have to worry about this or figure it out. Usually, when you have both, Medicare will pay for care first because Medicaid is considered the secondary payer.

Keep in mind that you always want to go to in-network providers that accept both of your plans. If not, then you might pay more for out-of-network costs if the provider does not accept both of your plans. The goal is for the two programs to work together to cover most of your health care costs if you qualify for both programs.

Family Plans

Medicaid does cover dependants while Medicare does not provide any family coverage. This means that if you are on Medicare and you have a dependant then that person can not get on your plan.

Medicaid on the other hand and their Children’s Health Insurance Program covers more than 45 million children.

Open Enrollment

Open enrollment for Medicare is from October 15 to December 7th. During open enrollment, you can make changes to your plan or plans. You also have three months after you turn 65 years old to sign up for a Medicare plan.

Medicaid does not have an open enrollment period. You can sign up for Medicaid at any time of the year if your income changes and you are eligible.

Options

When it comes to coverage options, medicare offers you a wealth of choices. You can go through all the plans and Parts and choose what is best for you before making a final decision. All the out of pockets expenses, premiums, and deductibles will vary so you want to make sure that you compare each cost.

With Medicaid, you will probably have only one choice (depending on the state you live in). The plan you are given will be through the state or it might be a care plan that is offered by a private insurer.

Medicaid

This is a federal and state program to help low-income Americans of any age pay for the costs that are associated with medical and long-term custodial care. If a child needs low-cost care but their families make too much money to qualify for Medicaid then they are covered through the Children’s Health Insurance Program (CHIP).

Anyone that is covered by Medicaid does not pay anything for covered services. Unlike Medicare that is only available to nearly every American that is 65 years of age or older. Medicaid does have strict eligibility requirements that vary by state.

Medicaid Eligibility

Because Medicaid is a joint program via the state and the federal government there are 50 different Medicaid programs (one for each state). When President Barack Obama was in office he attempted to expand healthcare coverage to more Americans by having the Federal government cover most of the Medicaid costs for people with an income level below 133% of the federal poverty level.

Because of the way that the percentage is calculated, it actually turns out to be 138% of the federal poverty level. There are a few states that use a different income limit and 33 of the 50 states have opted into this program.

The program was put in place to help the poor. Most states require Medicaid recipients to have no more than a few thousand dollars in assets in order to participate in Medicaid programs. There are also income restrictions that vary between states.

Medicaid Benefits

The benefits for Medicaid vary by state, the mandated coverage per the Federal government includes:

- Hospitalization

- X-rays

- Lab services

- Nursing services

- Family planning

- Nursing facility services

- Clinic treatment

- Midwife services

Every state also has the option of including additional benefits like prescription drug coverage, optometrist services, eyeglasses, physical therapy, prosthetic devices, and dental services.

Medicaid is normally used to fund long-term care that is not covered by Medicare or by most private health insurance policies. Medicaid is the nation’s largest single source of long-term care funding. Medicaid covers the cost of nursing facilities for anyone that depletes their savings to pay for healthcare and does not have any possible way to pay for nursing care.

Medigap

This is a supplement to Medicare coverage as we mentioned above. Medigap policies are designed to provide more coverage for routine services that Medicare does cover but does not cover all of the expenses. Things like dental, vision, and long term care.

The goal of Medigap is to be reimbursed for what you pay out of pocket for things such as deductibles or co-payments. You can expect to pay a higher price for the more coverage that you choose. If you opt for a cheaper plan you can expect to pay a higher deductible when you use the coverage.

Medicare is not a blanket insurance policy meaning that it has holes in it. Even if you have Parts A, B, and D coverage it might be far from all the costs that you may face if you have a sudden injury or become seriously ill. This is why Medigap comes in handy, this insurance will click in for those gaps (as the name implies) and it will also cover co-payments that come with your routine services.

Now You Know the Difference Between Medicare and Medicaid

As you can see there are quite a few differences between Medicare and Medicaid. Now that you are aware that they are not the same you can make better decisions going forward on what fits you and your lifestyle best. Messing around with your health coverage is not something you want to do so make sure that you stay on top of your health needs.

Did our blog post help you out today? Please browse around and check out more of our helpful reads.