One of the advantages of mutual funds is that it allows you to invest across different asset classes, including gold and foreign equities. Thus, your mutual fund portfolio can have a mix of investments as per your investment objectives and risk appetite.

Before you embark on your investment journey and choose mutual funds to invest in it is important that you do so with specific financial goals in mind. But your target corpus and the strategy necessary to achieve them could alter along the way which calls for periodic portfolio reviews. Revisiting the initial plan can help you rebalance and re-strategize your mutual fund investments and help you stay on the right track.

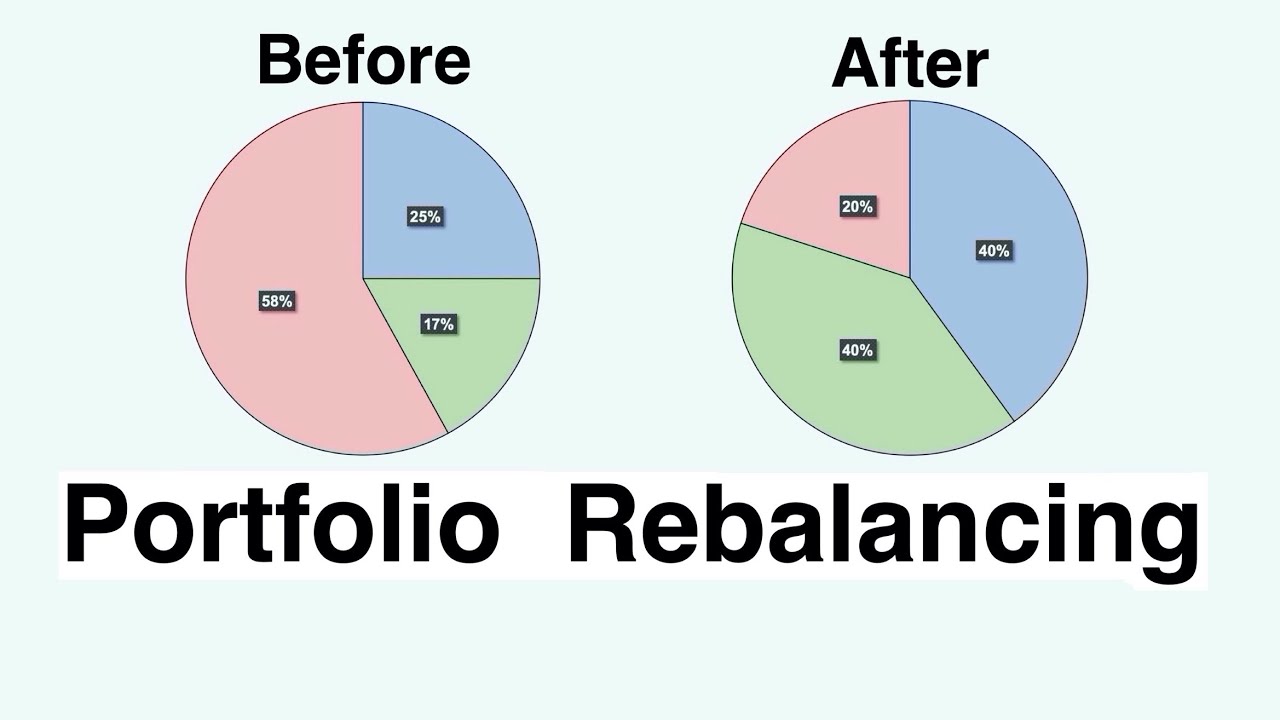

Here’s everything you need to know about rebalancing your portfolio.

What is portfolio rebalancing, and why is it important?

Rebalancing your investment portfolio means realigning the risk quotient of your investments and achieving the asset allocation that you have in mind. This is done by buying and selling investments.

Reviewing and rebalancing your portfolio can have several benefits. When you restructure your portfolio, you reduce the risk associated with it by selling loss-making funds. The readjustment also increases its potential to fetch returns as you establish the right asset allocation in line with your financial goals. Moreover, periodic rebalancing makes you keep up with market conditions and helps you make informed investment decisions.

What are the different grounds for portfolio rebalancing?

Five smart ways to rebalance your portfolio include:

- Rebalance based on the original master allocation

The original master allocation refers to the initial asset allocation that you adopted for your portfolio. Most experts recommend a buffer of 5%, either up or down, that can deviate from your initial allotment. However, if the number goes beyond this, it may be the time to re-distribute your money among different asset classes and go back to the original ratio.

- Rebalance before completion of goals

This involves the long-term rebalancing of your portfolio depending on how far away you are from achieving your goals. Say, you want to buy a house after 10 years. Your initial focus will be on capital appreciation so your portfolio may lean towards higher equity exposure.Whereas, as you move closer to your goal, in the 7th year or so, you will be more interested in capital protection. Thus, you would want to rebalance your portfolio to have more of debt and less of equity.

- Rebalance based on emerging trends in the market

Current and future market trends can change the course of your investments. Such fluctuations can bring about a need to take remedial actions. Such an approach can help you capitalize on the opportunities available at a given time.

- Rebalance based on rule-based theorems

You can set certain rules or trigger points for your asset allocation. For example, the price-to-earnings (P/E) ratio helps you understand whether a company’s stock is overvalued or undervalued. You can fix a rule that if your equity mutual fund investment goes beyond 15 P/E, you will reduce the equity component in your portfolio by 10%.

- Rebalance to make your portfolio more tax-efficient

You may have to switch funds or reconsider their holding period sometimes to save tax. Portfolio rebalancing can help you make the most of available tax exemptions and deductions. It also prompts you to let go of investments or decisions that add to your tax liability.

What are the steps to rebalance an investment portfolio?

- Review your portfolio regularly to gauge the need for rebalancing. Determine your asset allocation target based on factors such as your income, risk appetite, time horizon to retire, etc.

- If your current asset allocation does not match with the original and desired allocation strategy, then that is a good reason to rebalance your investment portfolio.

- Create a rebalancing plan for your portfolio. Write down which funds to buy and sell, along with the amount as well as the period or time of the transaction.

- Select any one of the five methods of rebalancing mentioned above. If you are rebalancing for an objective other than tax efficiency, do consider the tax implications of your decisions.

- Avoid frequent rebalancing because it is not only time-consuming but may also involve trading costs. You can rebalance your portfolio monthly, quarterly, half-yearly or annually based on your needs and the general market situation.

Investment portfolio rebalancing can be a great way to ward off risks and earn optimal returns from your investments. However, it is advisable to consult a financial advisor before you get started.