Crypto options and futures are two powerful derivative instruments that can revolutionize the way traders approach the cryptocurrency market. They’re great for hedging and for speculation, making them appealing to both risk-averse and risk-tolerant traders. But trading crypto derivatives in India can be daunting due to a lack of reliable and regulated platforms. This is where Delta Exchange India comes into the picture.

Crypto Option Trading with Delta Exchange India

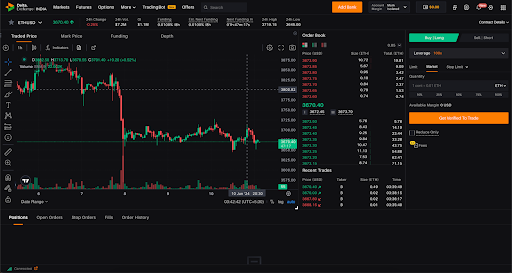

Like traditional options, crypto options are a type of derivative instrument that gives you the right (but not the obligation) to buy or sell a specific amount of the underlying cryptocurrency at a predetermined price, known as the strike price. This structure allows traders to manage risk, speculate on price movements, and capitalize on market volatility, all while leveraging the unique characteristics of cryptocurrencies. This flexibility makes them popular for traders who want to hedge their risks, speculate on price movements, or enhance their portfolio returns.

One of the biggest benefits of crypto options is that you can make settlements in fiat currency without holding the actual cryptocurrency. This is especially useful for traders who want to avoid the hassle of managing crypto holdings, such as storage and security, or dealing with the volatility of the crypto market.

Why Delta Exchange India?

Delta Exchange India is the country’s first FIU-registered crypto futures and options trading platform. This registration ensures that the platform is compliant with relevant laws and regulations, giving traders the peace of mind they need to focus on their trading strategies.

Delta Exchange India has made some major strides in the Indian cryptocurrency scene by introducing crypto futures and options trading at the lowest fees in the market. The platform has further solidified its position by acquiring the FIU-India registration, ensuring full compliance with relevant regulations. With daily trading volumes exceeding ₹2.274 Bn, Delta India has emerged as India’s fastest-growing crypto futures and options exchange, offering a cost-effective trading solution.

Crypto Futures Trading with FIU Registered Delta Exchange India

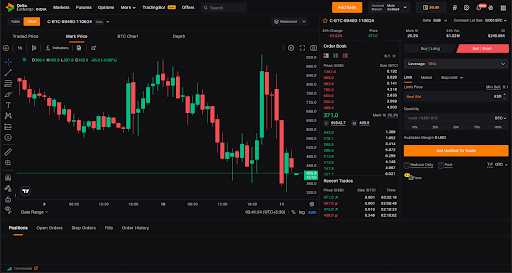

Crypto futures are a type of derivative contract that obligates you to buy or sell a specific amount of cryptocurrency at a predetermined price on a specific date. This means that you are committed to the trade and must fulfill the contract at the expiration date.

Crypto perpetual futures are similar to futures contracts but do not have an expiration date. Instead, they have an auto-roll feature. This feature is implemented via the exchange of funding every 8 hours, which means that the contract is continuously rolled over to the next period. This allows you to maintain your position without having to close and reopen it, providing a seamless trading experience.

Delta Exchange India offers a range of derivative instruments, including INR-settled European crypto options and perpetual futures in Bitcoin, Ethereum, and other altcoins. They are settled in INR, which means that your profits and losses are calculated in INR, eliminating the need for currency conversions and simplifying your trading experience. This makes it easy for beginner traders to start trading derivatives.

Benefits of Delta Exchange India

When it comes to trading cryptocurrencies, compliance with Indian legal standards is crucial. But that’s not all Delta India has to offer. Here are some unique benefits that set us apart:

- Advanced Risk Management: Our advanced risk management techniques allow you to make bigger trades with less capital while minimizing your risks. This means you can maximize your returns without sacrificing your financial security.

- Easy Deposits and Withdrawals: You can deposit INR to Delta Exchange India by linking your bank account and start trading. INR can be used as a margin for trading, and you can even withdraw in INR. This means all your trading activity can be done in INR, eliminating tax complications.

- Diverse Trading Opportunities: We offer daily, weekly, and monthly expiries in BTC and ETH options, giving you a wide range of trading opportunities. Be it a well-seasoned trader or a newbie, our diverse options will help you stay ahead of the curve.

- Tax Benefits: Trading crypto options and futures on Delta India has a significant tax advantage. Since your balances and unrealized profits are always denominated in INR, you’re not subject to the high tax rates on VDA (virtual digital assets). Plus, you can even offset losses, which isn’t currently allowed under Indian crypto regulations.

- INR-Settled Futures and Options: All Delta Exchange India contracts are quoted, margined, and settled in INR denomination. Users can trade futures and options on BTC and ETH with the convenience of settlement in INR.

Are you on the hunt for a reliable and compliant platform to trade crypto derivatives in India? Look no further than Delta Exchange India. Delta India is registered with the FIU-India, ensuring 100% compliance with Indian regulations. This means you can trade with confidence, knowing that your transactions are secure and compliant with local laws.

With over ₹2.274 Bn in daily trading volume, Delta Exchange India is India’s largest and fastest growing Crypto F&O exchange. This is a testament to the platform’s growing popularity and its ability to cater to the needs of Indian traders. Delta Exchange India’s user-friendly interface makes navigating and executing trades easy.

You can follow the action through Delta Exchange India’s website, as well as their social media on X and Instagram. You can also download their app through the Google Play Store.

Disclaimer: Cryptocurrencies are inherently volatile, and investments in the asset class can carry significant risks. The information presented in this article is not intended to be financial advice, and we strongly recommend conducting your due diligence before investing in crypto.