In the USA, the urgent need for cash to pay the bills groceries, gas, internet bills, or medicine in an emergency makes a helluva situation for them because they have to go out to the big predatory lenders who charge a handsome amount in the form of interest for such small amount which was just for emergency needs.

Then there comes an app Dave Banking which rescues us from this kind of heavy interest, in this article, we’ll try to understand in detail about the app with its usage, the owner details and joining fees, and some of the Pros and Cons of the app so that you can ultimately decide whether to join the platform or not. So Stay Tuned to the end.

What is Dave Banking?

It is a Fintech online platform that provides verified and qualified users cash in advance up to 75 dollars for their paychecks to cover their emergency and necessary expenses which include gas, medical bills, internet bills, or probably groceries. These cash advances can be used to pay your house rent or for the utility that you have experienced because the platform doesn’t have any hidden charges.

You don’t need to show any minimum balance fees to take cash in advance whereas the members of Dave Banking have the option to use the extra cash as quickly as possible because it is available in the form of direct deposit. The app has made a name for itself as an emergency app which is mostly used in the needy situations from the users.

It is often referred to as the Neobank which is available only online and people are using it in emergencies mostly. All the neo-banks want and have a primary goal to become the ‘primacy’ which is considered to be the primary account of the users which they use in every situation.

Dave Banking Memberships:

The platform charges monthly for its subscriptions 1 dollar and has made an option for an extra tip if a user is satisfied with their services and wants to pay more for the sustainability of the platform because it helps keep the platform alive for the needy users who can’t pay the extra tip.

The app provides notifications regarding the current checking amount if it gets low so that they can offer their services for you in the form of cash in advance. The platform offers 4% APY on both services whether it is a checking account or a savings account whereas the higher rate which they have initiated will be paid on all of the accounts of the platform for an indefinite time.

Dave Banking Owner and Starting:

The platform was launched back in 2017 by the CEO and founder Jason Wilk who has this idea of helping out the emergency needs of the common man of the USA in the Paycheck to paycheck segment by avoiding the drafting fees. They have been very successful in what they have dreamed of because the user base of Dave Banking is close to a million which is a huge number in the banking sector.

One of the Sharks from the Shark Tank, Mark Cuban invested in the app when he saw a futuristic goal with the application thinking and the possibility of a genius idea when you are combining the banking to the internet. The CEO has announced recently a new feature named ‘ExtraCash’ of the app where they are offering fee-free cash advances which can go up to 500 dollars if a verified user wants in the emergency and they have the option to pay until the next paycheck.

Dave Banking Pros and Cons:

There are many Pros and Cons the platform has for the users where they have kept in mind to provide the best services in the market and the complete satisfaction of the consumers is their utmost priority. But there are some minor cons that we have discussed that won’t minimize you in joining the platform instead, it’ll give you clarity of safety and security.

Dave Banking Pros:

- Budgeting Tool: Dave Banking offers a direct budgeting tool for the user that will link straight to their checking account which is just a value-for-money tool to know more about budget and daily life expenses in detail. This tool directly checks your account and analyzes your financial records and the whole information will be provided in the reading mode.

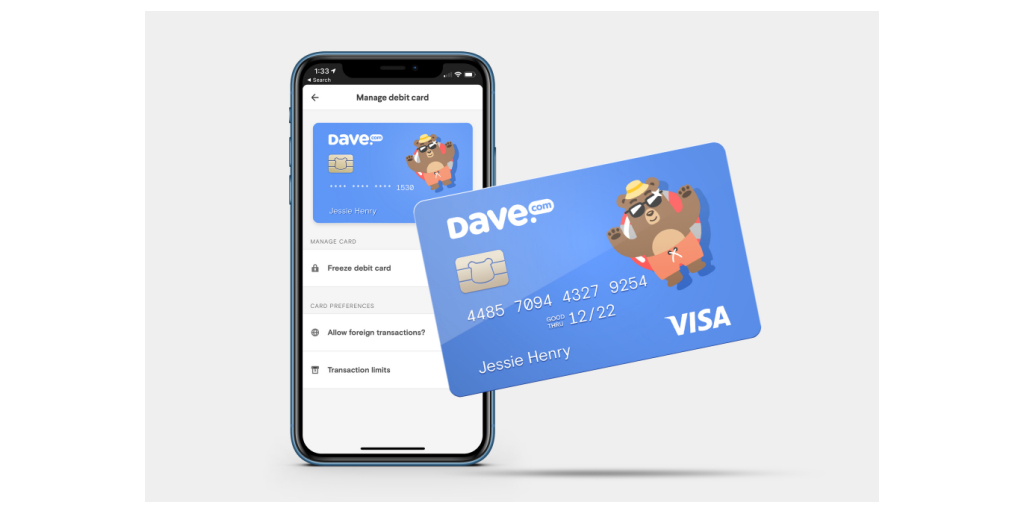

- Overdraft Protection: right after becoming a member of the app, it’ll provide every member a Visa debit card and the authority of a cash management account whereas Dave Banking charges nothing in overdraft fees and has no limit for the minimum amount in the opening of an account.

- No Effect on Credit Score: the most amazing feature of the platform is providing cash in advance to the users without affecting their credit score whether positively or negatively. This just takes a burden off the shoulders of the users when they take the cash advance in an emergency (all the time there is a worrying in their heads regarding credit score).

Dave Banking Cons:

- Instant Transfer Fees: the platform charges an instant transfer fee of 3 dollars only when you need an urgent cash advance in just one hour. But this shouldn’t interfere with your decision to join Dave Banking because this is a just minimal fee for the instant transfer when you are in an emergency.

- Cash Advance good or bad: this is, in general, many financial advisors are against cash advances because they think that when you are taking the cash advance, you are out of money and this is causing a dent in your financial condition, if it is going on regularly, it is a bad practice, you should not use Dave Banking. But if there comes a needy emergency once in a blue moon and you are out of cash, you should use the platform then it becomes a good way to help out.

To Sum Up:

Dave Banking is the platform that has earned the trust of the users by providing the services that are essential in an emergency and their motto has been exactly that since the start. We hope that people won’t become addicted to the platform, whereas they will use it cleverly according to their needs so that their financial exercise remains very well.