What is an FHA multifamily loan and what are the qualifications for obtaining one

An FHA multifamily loan is a government-backed mortgage used to finance the purchase or renovation of a multifamily property. Members of the Armed Forces, veterans, and certain other groups may qualify for benefits when obtaining an FHA multifamily loan. There are also income and credit score requirements that must be met to obtain an FHA multifamily loan. In addition, the property itself must meet certain safety and security standards to be eligible for financing. However, FHA multifamily loans can be an excellent way to finance the purchase or renovation of a multifamily property. With low down payments and favorable terms, these loans can help make the dream of owning a multifamily property a reality.

The benefits of an FHA multifamily loan

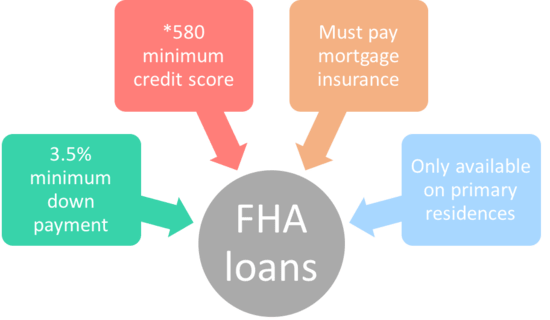

FHA multifamily loans are a great option for financing the purchase or construction of a small multifamily property. These loans are backed by the federal government and offer several advantages, including low down payments, flexible credit requirements, and competitive interest rates. In addition, FHA multifamily loans can be used to finance a wide variety of property types, including apartments, condos, townhomes, and more. As a result, these loans are an excellent choice for investors looking to finance the purchase or construction of a small multifamily property.

How to apply for an FHA multifamily loan

To apply for an FHA multifamily loan, borrowers must first locate an FHA-approved lender. Once you have found an approved lender, you will need to submit a loan application and supporting documentation. The next step is for the lender to review your application and determine whether you meet the eligibility requirements for an FHA loan. If you are approved, the lender will then issue a commitment letter outlining the terms of the loan. Finally, you will need to complete a few final steps to close on the loan and officially take ownership of the property. Applying for an FHA multifamily loan can be a complex process, but working with an experienced lender can help make the process go more smoothly.

The documentation that is required for a successful application

A successful grant application requires a significant amount of documentation. The applicant must provide detailed information about the proposed project, including its goals, objectives, and budget. In addition, the applicant must submit a complete list of the project’s personnel, as well as their qualifications and experience. Furthermore, the applicant must provide a detailed project timeline, outlining the major milestones that need to be achieved. Finally, the applicant must also submit letters of support from partner organizations or individuals. Without this extensive documentation, it is very unlikely that a grant application will be successful.

What happens after you are approved for the loan

After you are approved for a loan, the lender will send you a commitment letter. This letter outlines the terms of the loan, including the interest rate, monthly payment, and length of the loan. It is important to review the commitment letter carefully to make sure that you understand all of the terms of the loan. Once you have signed and returned the commitment letter, the lender will send you the funds. You will then be responsible for making monthly payments on the loan according to the schedule outlined in the commitment letter. If you have any questions about your loan, be sure to contact your lender. They will be happy to help you understand your obligations and answer any questions you may have.

The FHA multifamily loan program is a great way for developers to get their projects off the ground. If you’re interested in applying for an FHA multifamily loan, it’s important to understand the qualification requirements. Our team can help you through the process and answer any questions you may have about qualifying for an FHA multifamily loan.