The existing customers demand technological advancements that can secure them online and their online transactions. Accounts takeover, digital identity theft, and other online scams are potential risks for online businesses and customers. A survey in 2020 by Statista shows that identity fraud will rise by the rate of 39% in the coming 12 months, because of the Covid-19 pandemic. Businesses can verify their customers for secure and reliable onboarding through document verification.

How Document Verification is Done

An online user can be verified through his documents like ID, card, passport, and driving license. Identity Document Verification should be authentic and issued by government authority.

The process of online document verification is simple and is carried through the below steps

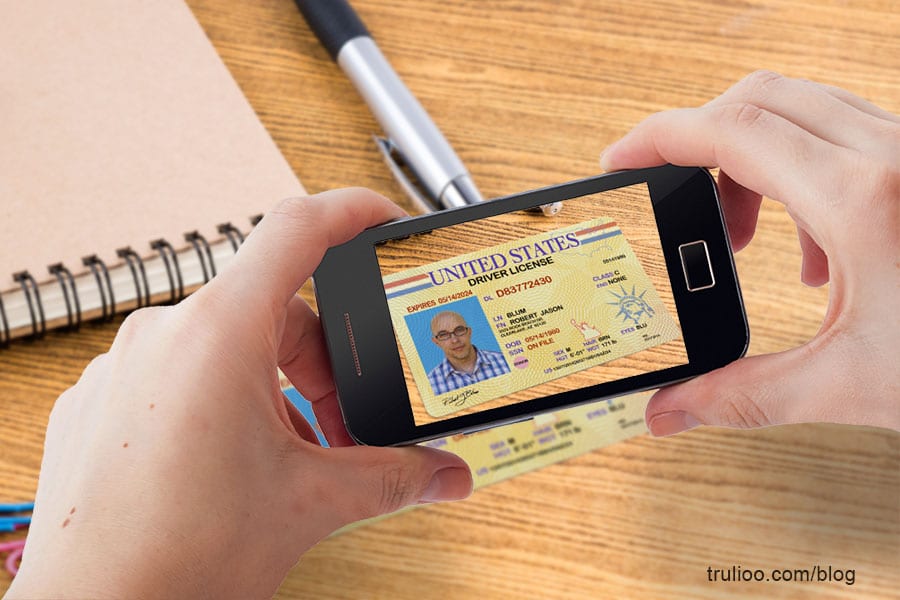

Capture or Upload

The online software demands an image of the identity document. User uploads or captures the image through a mobile camera or webcam. Software extracts the information on the document and also verifies the photo on the document with a live selfie of the user for identity proofing.

Screening of Documents

Documents are screened for checking false, modified, and tampered documents. Document verification software also checks the authenticity of the documents by examining signatures, edges, holograms, stamps MRZ (Machine Readable Zone) on them. Identity verification software is enabled with advanced AI for verification of documents and uses Optical Character Recognition for the data extraction from the documents.

Concluding Results

After the complete verification of documents and live selfie, results (verified or not verified) are dispatched to the website as well as shown to the user.

Industrial Use Cases of Document Verification

Financial Institutions

Financial Institutions are at risk of cyberattacks due to the involvement of money in it. Cybercriminals now use sophisticated ways for scams and frauds that cannot be countered by traditional verification methods. Financial Institutions have daily customer onboarding and continuous financial transactions. During account opening on online banks, a customer must be verified to kill any chances of identity theft. Cybercriminals try to impersonate some other user to open a bank account so that they can undergo their illegal proceedings on that. Sometimes they sign in to an existing account and transfer funds from such an account. Because of this, financial institutions face chargebacks from customers due to poor authentication methods.

As financial institutions have to adopt Know Your Customer and Anti Money Laundering compliances to combat money laundering, terror financing, and other crimes, document verification will help to comply with that.

Insurance Corporations

This industry is greatly affected by fake insurance claims based on false medical or death certificates. Fraudsters try to tamper health certificates and patient medical history to claim health insurance. Some others try to take vehicle insurance over the fake accident and repair reports. FBI study shows that the total cost of insurance fraud excluding health insurance is $40 billion per year. Document Authentication will help the insurance corporations to issue claims only on authentic documents. This will lessen the quantity of false health insurance claims.

E-commerce Businesses

These businesses need to verify both their sellers and buyers for the best business experience. Sometimes a scammer registers on an e-commerce website and takes the payment from the customer but as a result, doesn’t deliver anything. The other case is when a scammer purchases something with stolen debit/credit cards or by impersonating an authentic user. Both of these difficulties can be overcome by document verification. If the identity of sellers and buyers is verified, there are very few chances of scams.

Benefits of Online Document Verification

- Business can verify their customer remotely

- Gives more accurate results than manual verification

- Saves time and resources of a business while eliminating manual invasions

- Gives a better customer experience and convenience for customers

- Reduce chances of identity theft and account takeover

- A more secure online environment

- Compliance with KYC and AML regulations

Wrapping it up

Businesses can avail of Document verification services through third-party KYC providers. They verify the customer in just no time, remotely. Now the customer does not have to visit business offices for verification. Also, there is no call for any particular gadgets for it. The user can be checked through a mobile phone or laptop webcam. Businesses should adopt document authentication services for a seamless customer experience.

Meta Description: Businesses should adopt online document verification for the identification of the customers while enhancing the security and convenience for onboarding customers.