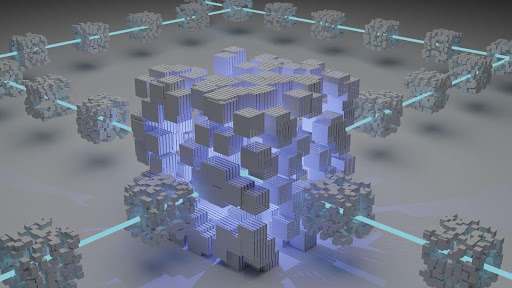

Tokenization of real-world assets using blockchain technology is gaining significant traction for its ability to democratize investment and enhance market efficiency. This process involves converting rights to tangible assets like homes, art, gold, and even financial instruments such as U.S. Treasuries into digital tokens on a blockchain. These tokenized assets offer increased liquidity, cost efficiency by cutting out middlemen, and round-the-clock market accessibility. By allowing fractional ownership, tokenization opens up investment opportunities to a broader range of people, making it an appealing option for both crypto enthusiasts and skeptics. Moreover, the security and transparency inherent in blockchain technology add to the attractiveness of this innovative investment vehicle.

Tokenizing real-world assets with cryptocurrency involves transforming the ownership of physical or intangible assets into digital tokens on a blockchain. This process typically includes several key steps:

- Defining the Asset: Identifying the real-world asset to be tokenized, such as property, art, or a financial instrument.

- Selecting a Blockchain: Choosing an appropriate blockchain platform for issuing the tokens.

- Creating Tokens: Generating digital tokens that represent ownership or a share of the identified asset. These tokens can be fungible or non-fungible, depending on the nature of the asset.

- Legal Compliance: Ensuring that the tokenization process complies with relevant laws and regulations, including those related to securities.

- Distribution and Trading: Distributing the tokens to investors or stakeholders, who can then trade them on various platforms.

Types of assets that can be tokenized include:

- Real Estate: Tokenizing property ownership allows for fractional ownership and easier liquidity.

- Art and Collectibles: Digital tokens can represent ownership of artworks or collectibles, making them more accessible to a broader range of investors.

- Financial Instruments: Stocks, bonds, and other financial instruments can be tokenized for increased accessibility and liquidity.

- Commodities: Tokenizing commodities like gold or oil can simplify trading and ownership transfer.

- Intellectual Property: Rights to music, patents, or software can be tokenized for easier management and monetization.

- Private Equity and Venture Capital: Tokenization can enable fractional ownership of private equity or venture capital investments.

Tokenization of real-world assets offers numerous benefits, such as increased liquidity, accessibility, and efficiency in transactions. However, it also requires careful consideration of legal, technical, and market aspects.