Simple and can be completed via the Chime program or site in only two minutes. You ought to be a U.S. citizen who’s at least 18 years old to start an account, and all you will need is a couple of pieces of personal info to apply. Once your eligibility is verified, you are going to be a fresh Chime member. Since Chime is a mobile-only lender, you will need to download the Chime cellular program via your smartphone. As soon as you complete your accounts in the program, you can set up direct deposit to fund your accounts.

How to withdraw money?

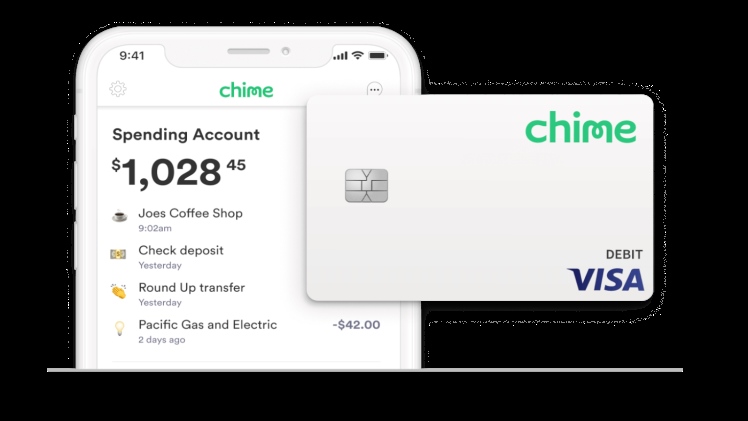

Chime members are provided with a debit card whenever they start a Chime spending account that may be utilized for purchases and ATM withdrawals. Please visit chime spending limit here.

Chime customer service

Chime’s Member Services team may be reached 24/7 via the customer care tab at the Chime program or by email at support@chimebank.com. You may contact one of their telephone pros by dialing 844-244-6363; they are available Monday through Saturday from seven a.m. to 7 p.m. CST or Sunday from 9 a.m. to five p.m. CST.

Common questions about Chime

Is banking with Chime safe?

Chime uses a variety of bank-level safety processes to safeguard your cash is always secure. Get instant transaction notifications. If you see an unauthorized transaction, you’re able to immediately Chime bank accounts are also guaranteed by that the FDIC (Federal Deposit Insurance Corporation) about $250,000.

Can you withdraw money Savings Account?

You can withdraw cash from the Chime Savings Account by moving it to your own spending account with the site or cellular program. Online transfers from the savings account are limited to six per statement cycle, per federal regulations. Please visit cashcardgreen for more details.

How much money can I withdraw?

Chime does not limit the amount of times you can use your Chime Visa Debit Card, however, it will restrict the sum of money which can be spent using the card every day.

What we like about Chime

Get your paycheck early: Chime members that put up direct deposit are automatically eligible to get their pay up to 2 days. How? Employers frequently deposit your cash up to 2 days before it is made available for you at most banks. Chime makes your cash available when your employer residue it.

No hidden fees: Fundamentally no charges whatsoever, for the issue. No overdraft charges, no monthly maintenance fees, no monthly service charges, no minimum balance charges, no overseas transaction charges, and more than 38,000 fee-free Money Pass ATMs.

Save automatically: Chime’s Savings Account has many attributes that enable you to automate your savings, for example automatic transfers along with a choice to save when you pay. You may opt to automatically move a proportion of each paycheck into your Savings Account to place aside extra cash toward your targets. You might also have each debit card transaction piled up to the closest dollar. That curved amount will then be transferred automatically in the Spending Account to your Savings Account.

A decent savings rate: The Chime savings account offers a generous 1.00% APY (as of July 7, 2020) — that the ordinary APY for conventional savings account is merely 0.06percent (as of July 7, 2020).

Easy deposits: To get a lender with no bodily places, it is rather simple to create deposits with Chime. Direct deposit is the simplest way to add funds to your accounts, but Chime additionally supports cellular test deposits, electronic funds transfers, and cash flows. Cash deposits are offered at over 90,000 retail places — such as Walgreens, CVS, and 7-Eleven — utilizing the Green Dot Network.