If you accept payment through a debit or credit card, you have no doubt noticed a three-or four-digit code at its front or back. These unique numbers are highly significant. Surprisingly, though, few operators go the extra mile to learn more about them.

Studies conducted in late 2019 revealed that although there was an increase in the number of merchants accepting credit cards in 2019 than 2018, a mere 10% of these operators realize the importance of a CVV code.

So what is a cvv code? Why is it a game-changer in your business, and why should you put that extra effort into learning more about it? Here are some answers to these and many more CVV-related queries.

What is a CVV Code?

A CVV code is a commendable answer to all your business woes. They help prevent identity fraud, therefore protecting the integrity of your enterprise. CVV code or Card Verification Value in long-form is a unique set of digits found in most debit and credit cards.

Other credit cards, such as the Apple Card, do not have their CVV code printed on them. In case you come across such a card, no worries. You can still make a transaction. All you have to do is ask your customer to call their card issuer for their security code.

Thanks to PCI, or Payment Card Industry, standards, you can store your customer’s credit card expiration date and number. This helps you know that you are accepting a legitimate card.

Where Can You Find a CVV Code?

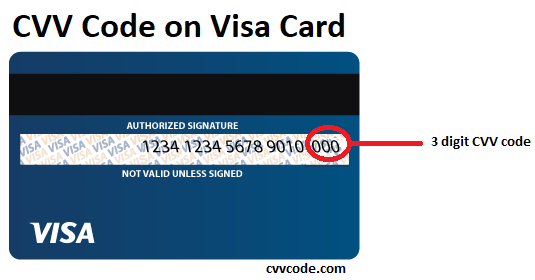

If your customer’s card is American Express-branded, you can find their four-digit code on the front end right above the Amex logo. If they are Discover, Visa, or Mastercard users, their three-digit CVV code is at the back of their card, usually just above or inside the signature strip.

Why is it Essential to Learn About a CVV Code?

If you’re a merchant, a CVV code can also protect you from a chargeback. Chargebacks may be beneficial to clients, but they affect your source of livelihood as a trader.

A chargeback is the reversal of a credit card payment that comes straight from a financial institution. If a consumer is the victim of identity theft, they have a right to file for a chargeback should the thief make a fraudulent buy.

Aside from the well-known loss of funds from your commercial merchant account, there are other reasons why you should never give a reimbursement the cold shoulder such as:

- Though you have a right to refute a chargeback dispute, it takes time and skill to make an effective dispute. Without professional assistance, you may not get the victory you deserve.

- In the event of a dispute, your merchant account is still at risk of termination even when you win it.

- Should a client file for remuneration and decide to keep the merchandise, you lose that revenue and all future potential for an extra buck.

- If your account is terminated, your establishment is placed on the MATCH list. The list is handled and created by Mastercard. It contains details about establishments and their owners whose credit card processing rights have been discontinued for various reasons. Your enterprise cannot open a new account with another processor for five years.

- Every time a customer files for a refund, you receive a fee that ranges from $20 to $100 for each transaction. In case the client cancels the reimbursement, you will still have to pay administrative charges and costs associated with the procedure.

The good news is, with a CVV code, you can tell if it’s a particular client making the purchase. Hence chargeback incidences are slim to none. Please note that sometimes customers can falsely claim that a purchase is fraudulent, commonly referred to as ‘friendly fraud.’

Are you thinking, ‘what is a CVV code?’ Since the online transaction law is mostly on your clients’ side, it is very important that you know what a CVV code is as well as how chargebacks work.

Is it Alright to Ask a Customer for His or Her CVV Code?

Absolutely yes, but under very specific circumstances. If, for example, your client is using their card in person, you will not have to ask them for it. The CVV code does not show up when the card is scanned in the usual way.

On the other hand, if a customer is buying an item via phone, you can ask them for the CVV code for authenticity purposes. If you have a credible website, your customers will not have second thoughts about sharing their code when making an online purchase.